Hyderabad: The National Payments Corporation of India (NPCI) on Monday announced a revision of Unified Payments Interface (UPI) limits, effective September 15, 2025, to support high-value digital payments.

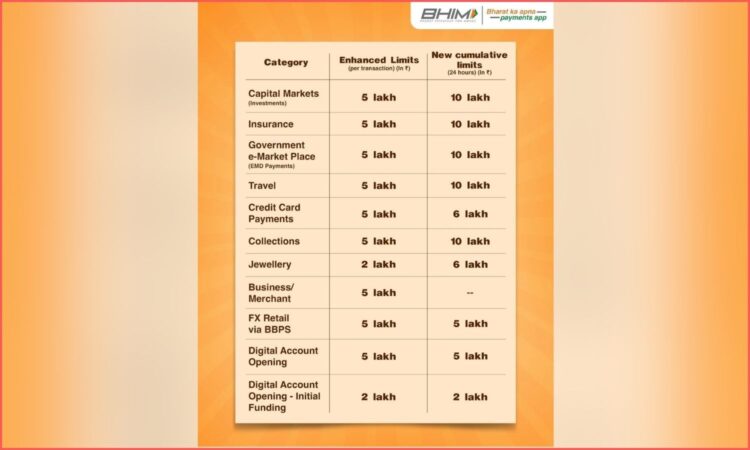

NPCI raised the per-transaction cap to Rs 5 lakh across several categories. It also sets daily limits of up to Rs 10 lakh, depending on the use case. The enhanced caps cover insurance premiums, capital market investments, Government e-Marketplace (GeM) transactions, and travel bookings.

Category-wise limits and daily caps

For credit card bill payments, users can pay up to Rs 5 lakh per transaction and Rs 6 lakh in a day. Jewellery purchases will allow up to Rs 5 lakh per payment and Rs 6 lakh daily. Merchant and business payments remain capped at Rs 5 lakh per transaction, with no daily aggregate cap.

Additionally, foreign exchange retail transactions via BBPS will carry a Rs 5 lakh limit. Digital account opening funding will permit up to Rs 5 lakh per transaction, while the daily total will remain capped at Rs 2 lakh. However, peer-to-peer transfers will continue under the existing Rs 1 lakh ceiling.

NPCI said the step responds to demand for higher flexibility and smoother large-value payments. It noted that UPI has become the preferred mode for individuals and businesses, and higher limits will reduce the need to split payments.

UPI, developed by NPCI and overseen by the Reserve Bank of India, runs on the IMPS network and enables instant bank-to-bank transfers. With the new limits, users can execute larger transactions in a single payment, further strengthening India’s digital-first economy.